The Impact

How would a beverage tax impact Rhode Island?

In the past, the legislature has introduced legislation that would increase beverage taxes and hurt working families, small businesses and their employees the most. There is a chance that the same or similar legislation will be introduced again. This is the impact that legislation would have on Rhode Island

- This is not just a tax on soda. Hard-working Rhode Islanders will struggle to afford common grocery items such as sugar-sweetened beverages including flavored coffee drinks, sports drinks, teas, sodas, energy drinks, lemonades, kombuchas, flavored waters, certain fruit drinks – even frozen lemonade and coffee syrup.

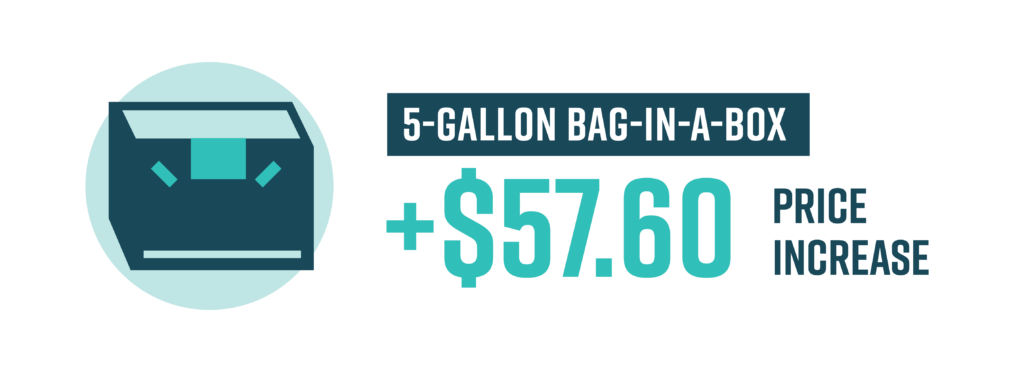

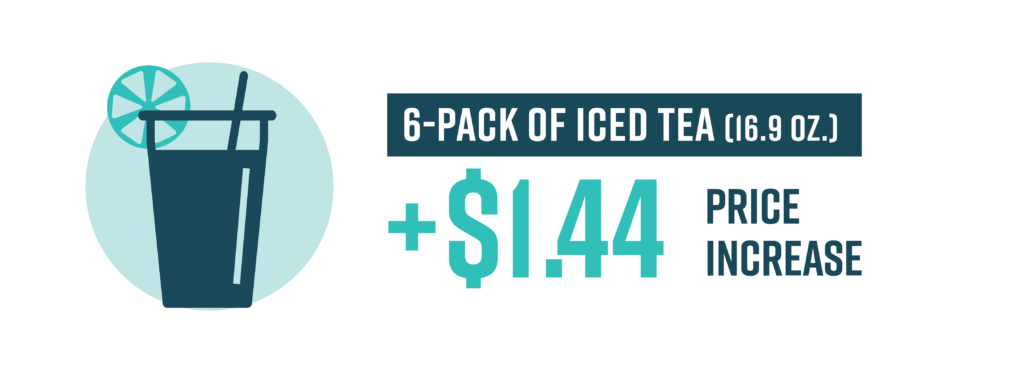

- Costs are rising for working families in Rhode Island. Inflation, supply chain issues, and the price of gas are making everyday items more expensive. A beverage tax will increase the cost of common grocery items for working families who cannot afford it.

- Local businesses have worked hard to recover from the challenges of the pandemic. A large tax on beverages is another burden placed on businesses and would lead to job losses and higher prices.

- This tax could impact more than 4,200 workers and lead to a loss of at least $100 million in annual retail and restaurant sales.

If passed, many residents will drive across the state border to shop Massachusetts and Connecticut; this will only hurt Rhode Island businesses and deprive the state of revenue.

The state has had an influx of funding after receiving historic levels of federal dollars and still ended up with a deficit. But putting more costs on working families is no way to address a budget deficit. Now is the time to support small businesses and families, not enact a tax that would make it even harder for them to recover.

BOTTOM LINE: Rhode Island working families, small businesses and employees cannot afford a costly new tax.